Reward the routine with Xtra Bonus! 😊

A free checking that rewards your everyday spending! Xtra Bonus Checking is here to reward your routine! Use your card for regular purchases and watch the cash back pile up! Whether you’re buying groceries, grabbing gas, or treating yourself to a night out, you’ll be earning cash with every swipe.

Xtra Bonus Benefits

- Earn 4% cash back on your debit card purchases (must post and settle) up to $200.

- Cha-ching: Receive up to $25 in ATM withdrawal fee refunds.

- Whoops! We all slip up sometimes. Don’t worry. We’ll waive overdraft fees for small mistakes under $10. Boom – that’s great service.

- Boost your saving balance with an Xtra savings and earn 2.75% APY* on balances up to $100,000!

- Add-ons: Identity Theft Protection or the Executive Package (paper statements, free incoming wires, debit card replacement and counter checks) for a low monthly cost.

*APY = Annual Percentage Yield.

Ditch the ordinary, earn the Xtraordinary! 🙂

Xtra Cash Checking is like a disco ball for your dollars – flashy, fun, and guaranteed to make your money boogie.

So ditch the dusty piggy bank and move your money to a place that celebrates your financial awesomeness. Because hey, you deserve a checking account that’s as fun and rewarding as you are! Sign up today!

Xtra Cash Comps

- Stash up to $25,000 in this bad boy and watch your cash flow grow with a sweet 4.00% APY* It’s like magic but without the questionable mustache and top hat.

- Speaking of Magic: Magically receive up to $25 in ATM withdrawal fee refunds.

- Life happens! We understand occasional mishaps. We’ll waive overdraft fees under $10. #HereToHelp

- Boost your saving balance with an Xtra savings and earn 2.75% APY* on balances up to $100,000!

- Add-ons: Identity Theft Protection or the Executive Package (paper statements, free incoming wires, debit card replacement and counter checks) for a low monthly cost.

*APY = Annual Percentage Yield.

Basic Checking

A free Basic Checking that gets the job done. This account’s got your financial moves covered, with no fancy footwork required.

Looking for a no-frills option? This account is for you.

It offers a straightforward way to manage your money without extras like rewards or ATM reimbursement. Choose eStatements to keep it free, or there is a $3 monthly fee for paper statements.

Protection for the whole family.

Secure Checking

Don’t be a target. Identity theft strikes fast.

In fact, it happens every two seconds. Secure your future with Secure Checking and get ID Protect® included (registration required). This service provides Identity Theft Monitoring and Resolution to keep you and your family safe.

For those over 55, we offer Secure 55+ Checking with the same protection, plus two free boxes of checks annually. Get rewarded with sweet dividends on every penny over $2,500. Ka-ching! Building your nest egg just got way more fun!

need help?

I’d like to…

Checking FAQs

Are checking accounts insured?

Yes, checking accounts are insured up to $250,000 by the National Credit Union Administration (NCUA). NCUA is an agency of the federal government.

What is Direct Deposit?

Direct deposit is an electronic payment method where funds are transferred directly into your account, commonly used for payroll or social security. Deposits are automatic, secure, and immediately available.

Your employer can set up direct deposit. Give them your account number and our routing number: 292977666.

What is an ACH?

An ACH (Automated Clearing House) is an electronic network for processing financial transactions for payments and transfers, including direct deposits and bill payments.

Are checking account bonuses taxable?

Yes, checking account bonuses are generally considered taxable income. When you receive a checking account cash bonus, you must report this income on your tax return and pay any applicable taxes.

How do checking accounts work?

A checking account allows you to deposit and withdraw money easily and offers access to and manage your day-to-day financial transactions.

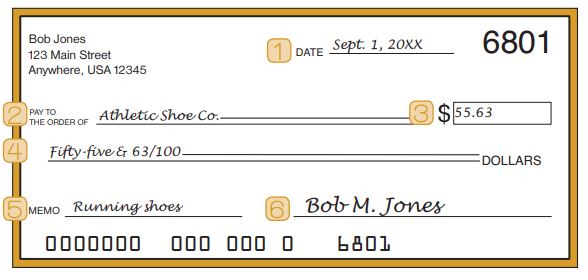

Where is the routing number on a check?

The routing number on a check is the first set of numbers (usually nine digits) located in the bottom left corner. The second set of numbers immediately to the right of the routing number is the account number. The third set of numbers is the check number, as you can see at the bottom of this graphic.

Can checking accounts have beneficiaries?

Yes, checking accounts can have beneficiaries designated to allow the account holder to specify who will receive the funds upon their death. The beneficiary does not have access to the funds while the account holder is alive but will inherit the funds directly upon the account holder’s death, bypassing the probate process.

Can a checking account go negative?

Yes, a checking account can go negative if you spend more money than you have available, which is often referred to as an overdraft. Overdraft fees may be assessed. It’s important to keep track of your balance to avoid going negative.

Can a checking account affect your credit?

Generally, a checking account does not directly affect your credit score, as it is used for managing day-to-day finances and does not involve borrowing money or incurring debt, which are the activities that influence your credit.

Can I open a checking account online?

Yes, you can open an Altana checking account online and choose the option that’s right for you. Current members can add a checking account here, and new members can join Altana and open a checking account here.

When should you open your first checking account?

Opening your first checking account is typically a good idea when you start earning money from a part-time job or internship. It is practical when you begin to handle more financial transactions independently and need a safe place to store and manage money.

How can I get more Altana checks?

Checks can be reordered online. You can also call Harland Clark at 1.800.275.1053, Altana at 406.651 AFCU (2328), mail in your reorder form, or bring it to one of our branches.

Have a question not answered here?