Fraudsters are coming up with new ways to steal your money and personal information. But don’t worry; we’re here to help you stay safe. We offer a variety of tools and resources to help protect you. 🔒

In this section, you’ll learn about:

Scams to Watch For

Prevention Strategies

How to Report Fraud

Altana will never call you and ask for personal information, such as account or PIN numbers. If you get a call like this from Altana, hang up and call us back directly at (406) 651-AFCU, Option 1 or (800) 221-7555.

Fraud Alert: Scammers are spoofing our 800 number to trick you into providing personal information!

Here’s how it works:

- Spoofing: Scammers can manipulate caller ID to display a fake 800 number, making it appear as if the call is coming from a trusted source like Altana FCU.

- Phishing Attempt: The caller may try to:

- Gather personal information: Such as your Social Security number, account details, passwords, or credit card information.

- Install malware: By tricking you into downloading malicious software onto your computer.

- Demand immediate payment: For fake debts or services.

- What to do if you receive a suspicious call:

- Do not provide any personal information.

- Do not engage with the caller.

- Hang up immediately. Call us directly at 800-221-7555 or 406-651-AFCU (2328) to verify the legitimacy of the call.

- Remember: We will never ask you for sensitive information over the phone. If you suspect a call is fraudulent, report it to the authorities. Stay safe and vigilant!

SMS Message Scams

Be wary of where you click.

If you receive an SMS message supposedly about a fraud alert, be skeptical. 📱🤨

This “Smishing” scheme tries to scare you into believing the scammers are representatives of your credit union. An automated SMS message will appear on your phone, claiming to be a fraud alert. It’ll then ask if you recently made an instant payment in the thousands of dollars.

- Keep an eye out for misspelled words which are used to bypass a phone carrier’s filter system for fraud.

- Do not click on the link or call the number on the text.

- Do not respond to the text. Even writing STOP will let the scammer know your number is genuine.

- If a call or text is received regarding possible fraud or unauthorized transfers, immediately hang up.

- Never click on links provided in unsolicited texts or emails.

- The best way to protect yourself is to say, “Let me call you right back,” then call the credit union yourself.

- Never answer any questions from a random call.

- Do not post sensitive information online.

Be in the Know

Scams to Watch For

Get informed and

stay alert…

Your Money, Our Shield

Security is Top Priority

We’re serious about keeping your cash safe. Here’s how we do it:

- Locked Down: Your personal information is encrypted like a top-secret spy code.

- Secure Login: Your online banking session is authenticated with encrypted user ID and password/PIN.

- You’re Covered: We log you out of digital banking automatically if you forget.

- Picture Perfect: The watermark image you choose lets you know you’re logged in the right place.

- Extra Vigilance: Our system constantly monitors for suspicious activity.

Your Part in the

Protection Plan

You’re the superhero of your finances! Here’s how to keep your money safe:

- Lock it Down: Create a super strong password and keep it secret from everyone.

- Log Out: Hit that “Log Out” button before you close a webpage and never leave your computer unattended when logged in.

- Stay Updated: Keep your computer safe with the latest software updates.

- Be Smart: Don’t share your info with strangers, online or over the phone.

- Guard Your Card: Learn the helpful strategies to mitigate fraud on your debit card at our Debit Card page.

- Sound the Alarm: Let us know right away if something seems off.

- Shop Safe: Avoid shopping on public Wi-Fi. Your home network is the safest bet.

- Clean Up: Clear your cookies and browser history after shopping to protect your privacy and prevent accidental discoveries.

- Use the Vault: Password managers are like super-secret vaults for your logins. Just remember one master password, and you’re in! Popular choices include Lastpass, Dashlane, and Roboform.

Protect Your Identity

Shred, Check, and Be Wary

- Shred It: Protect yourself from identity theft by shredding sensitive documents like receipts, credit offers, and financial statements.

- Stay on Top: Regularly check your accounts and credit report for any suspicious activity.

- Be Smart: Don’t share personal information over the phone unless you initiated the call.

Keep your peace of mind

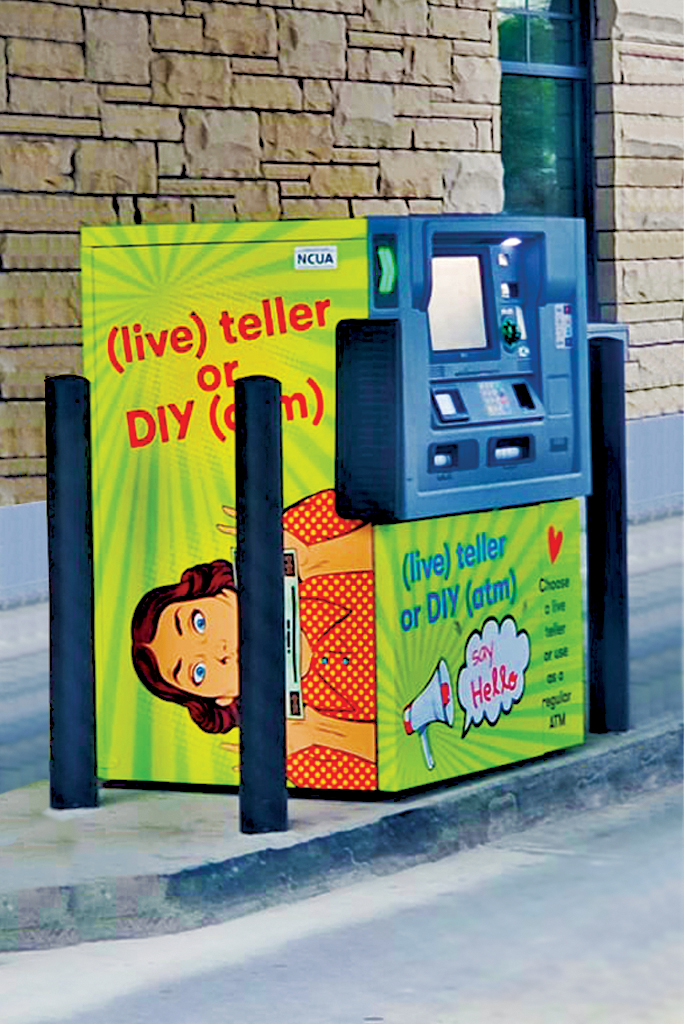

ATM Safety Tips

- Lock your car and keep your windows up.

- Be aware of your surroundings, especially at night.

- Don’t write your PIN on your card.

- Report any suspicious activity to the police.

- Shield your PIN when using cards in public places.

Altana Member Services

If you suspect fraud on your account, please call us right away.

(406) 651-AFCU, Option 1 or (800) 221-7555

Fraud & Safety FAQs

What does Altana Federal Credit Union do to protect my personal information?

Altana employs advanced security measures, including encryption, fraud detection systems, and employee training, to safeguard your information.

How can I protect myself from online scams?

Be cautious of unsolicited emails, texts, or calls asking for personal information. Never click on links or download attachments from suspicious sources.

What should I do if I think my account has been compromised?

Contact Altana Federal Credit Union immediately at (406) 651-AFCU, Option 1 or (800) 221-7555 or email, contactus@altanafcu.org.

Is online banking and the mobile app secure?

Yes, our digital banking and mobile app utilize advanced security protocols to protect your information.

What should I do if my debit card is lost or stolen?

Contact Altana Federal Credit Union immediately at (406) 651-AFCU, Option 1 or (800) 221-7555 to report the lost or stolen card.

What is identity theft?

Identity theft is the unauthorized use of someone else’s personal information.

How do I spot a bogus email?

To identify a fake email, look for these tell-tale signs:

- A fishy email address. If it looks overly long or otherwise clearly is not associated with your credit card issuer, then delete.

- A generic salutation. Does the email begin with “Dear Customer” and appear to know very little about you? Most legitimate emails include the four digits of your credit card number.

- A suspicious link to your account or login. Never click on a link in an email—it’s safer to just go to your account login manually using a bookmark or type the URL. If you have questions about a card, call the 800-number on the back.

Have a question not answered here?