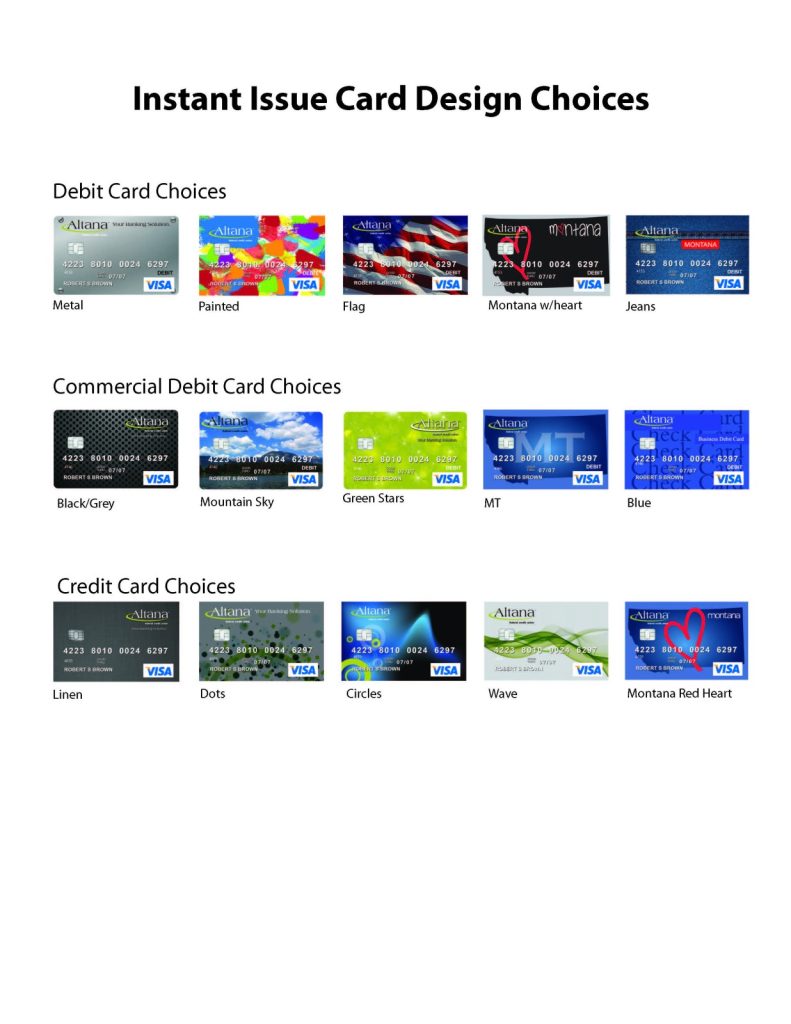

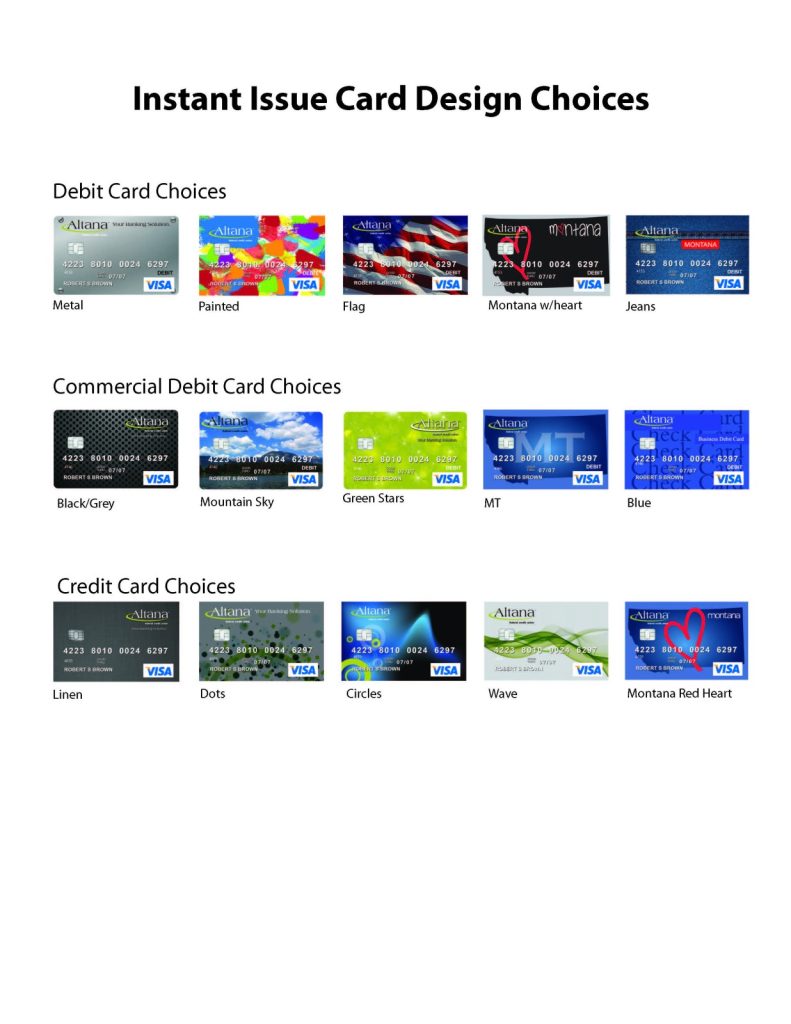

Card Designs

Card Designs

Enrollments must be in place and all of the following transactions and activities must post and settle to your checking account during each Monthly Qualification Cycle:

That’s it! Even if you don’t qualify one month, your account is still free — and you can get right back to earning xtras the very next month.

| Account Type | Rate* | APY* |

| Metro Savings (ADB Under $10,000) | 1.045% | 1.05% |

| Metro Savings ($10,001+) | .03% | 0.03% |

| Sam Money Market (ADB under $25,000) | .03% | .03% |

| Sam Money Market ($25,000 - $49,999.99) | 2.227% | 2.25% |

| Sam Money Market ($50,000 - $74,999.99) | 2.716% | 2.75% |

| Sam Money Market ($75,000 - $99,999.99) | 3.203% | 3.25% |

| Sam Money Market ($100,000+) | 3.687% | 3.75% |

| Max Money Market (ADB under $99,999.99) | .03% | .03% |

| Max Money Market ($100,000 - $249,999.99) | 3.687% | 3.75% |

| Max Money Market ($250,000+) | 3.928% | 4.00% |

| ACE Money Market (ADB under $250,000) | 0.499% | 0.50% |

| ACE Money Market ($250,000+) | 4.208% | 4.29% |

| Coverdell, Traditional & Roth IRA Shares (ADB under $10,000) | .05% | .05% |

| Coverdell, Traditional & Roth IRA Shares ($10,000 - $24,999) | .10% | .10% |

| Coverdell, Traditional & Roth IRA Shares ($25,000 - $49,999) | .15% | .15% |

| Coverdell, Traditional & Roth IRA Shares ($50,000 - $99,999) | . 20% | .20% |

| Coverdell, Traditional & Roth IRA Shares ($100,000+) | .25% | .25% |

| Wealth Builder Savings Account (up to $10,000) | 1.045% | 1.05% |

| Wealth Builder Plus Savings Account ($2,500 - $19,999) | 1.045% | 1.05% |

| Secure Checking ($2,500 - $10,000) | .05% | .05% |

| Secure 55+ Checking (ADB $2,500) | .05% | .05% |

| Christmas Club (up to $5,000; ADB >$5,000 earns 0.000%) | .25% | .25% |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APY = Annual Percentage Yield & APR = Annual Percentage Rate

To ensure you have the most current rates, please use your browser’s refresh button to update this page. Rates subject to change without notice. Some restrictions may apply, please contact Altana Federal Credit Union. To earn the stated Annual Percentage Yield, a minimum balance must be maintained daily. Dividends will be calculated daily, compounded and credited to your account monthly. Ask for details and restrictions. Transaction limitations may apply. Internet access may be unavailable. A penalty may be imposed for early withdrawal or closing.

| Type | Minimum | Rate* | APY* |

| Cubby/fyi Certificates 6 Months | $100 | 1.045% | 1.05% |

| Cubby/fyi Certificates 12 Months | $100 | 1.144% | 1.15% |

| 6 Month Certificates | $500 - $9,999 | 1.045% | 1.05% |

| 6 Month Certificates | $10,000 - $24,999 | 1.094% | 1.10% |

| 6 Month Certificates | $25,000 - $49,999 | 1.144% | 1.15% |

| 6 Month Certificates | $50,000 - $99,999 | 1.243% | 1.25% |

| 6 Month Certificates | $100,000+ | 1.342% | 1.35% |

| 12 Month Certificates | $500 - $9,999 | 1.342% | 1.35% |

| 12 Month Certificates | $10,000 - $24,999 | 1.440% | 1.45% |

| 12 Month Certificates | $25,000 - $49,999 | 1.539% | 1.55% |

| 12 Month Certificates | $50,000 - $99,999 | 1.687% | 1.70% |

| 12 Month Certificates | $100,000+ | 1.785% | 1.80% |

| 18 Month Certificates | $500 - $9,999 | 1.638% | 1.65% |

| 18 Month Certificates | $10,000 - $24,999 | 1.736% | 1.75% |

| 18 Month Certificates | $25,000 - $49,999 | 1.834% | 1.85% |

| 18 Month Certificates | $50,000 - $99,999 | 1.982% | 2.00% |

| 18 Month Certificates | $100,000+ | 2.080% | 2.10% |

| 24 Month Certificates | $500 - $9,999 | 1.736% | 1.75% |

| 24 Month Certificates | $10,000 - $24,999 | 1.884% | 1.90% |

| 24 Month Certificates | $25,000 - $49,999 | 2.031% | 2.05% |

| 24 Month Certificates | $50,000 - $99,999 | 2.178% | 2.20% |

| 24 Month Certificates | $100,000+ | 2.276% | 2.30% |

| 36 Month Certificates | $500 - $9,999 | 1.785% | 1.80% |

| 36 Months Certificates | $10,000 - $24,999 | 1.933% | 1.95% |

| 36 Month Certificates | $25,000 - $49,999 | 2.080% | 2.10% |

| 36 Month Certificates | $50,000 - $99,999 | 2.227% | 2.25% |

| 36 Month Certificates | $100,000+ | 2.374% | 2.40% |

| 60 Month Certificates | $500 - $9,999 | 1.785% | 1.80% |

| 60 Month Certificates | $10,000 - $24,999 | 2.080% | 2.10% |

| 60 Month Certificates | $25,000 - $49,999 | 2.227% | 2.25% |

| 60 Month Certificates | $50,000 - $99,999 | 2.374% | 2.40% |

| 60 Month Certificates | $100,000+ | 2.570% | 2.60% |

| IRA 12 Month Certificates | $500 - $9,999 | 1.342% | 1.35% |

| IRA 12 Month Certificates | $10,000 - $49,999 | 1.539% | 1.55% |

| IRA 12 Month Certificates | $50,000 - $99,999 | 1.687% | 1.70% |

| IRA 12 Month Certificates | $100,000+ | 1.785% | 1.80% |

| IRA 24 Month Certificates | $500 - $9,999 | 1.736% | 1.75% |

| IRA 24 Month Certificates | $10,000 - $49,999 | 2.031% | 2.05% |

| IRA 24 Month Certificates | $50,000 - $99,999 | 2.178% | 2.20% |

| IRA 24 Month Certificates | $100,000+ | 2.276% | 2.30% |

| IRA 36 Month Certificates | $500 - $9,999 | 1.785% | 1.80% |

| IRA 36 Month Certificates | $10,000 - $49,999 | 2.080% | 2.10% |

| IRA 36 Month Certificates | $50,000 - $99,999 | 2.227% | 2.25% |

| IRA 36 Months Certificates | $100,000+ | 2.374% | 2.40% |

| IRA 60 Month Certificates | $500 - $9,999 | 1.785% | 1.80% |

| IRA 60 Month Certificates | $10,000 - $49,999 | 2.227% | 2.25% |

| IRA 60 Month Certificates | $50,000 - $99,999 | 2.374% | 2.40% |

| IRA 60 Month Certificates | $100,000+ | 2.570% | 2.60% |

| Coverdell Education Savings Certificate 12 Months | $100 | 1.144% | 1.15% |

| Coverdell Education Savings Certificate 24 Months | $100 | 1.736% | 1.75% |

| Coverdell Education Savings Certificate 60 Months | $100 | 1.785% | 1.80% |

To ensure you have the most current rates, please use your browser's refresh button to update this page. Rate = Annual Percentage Yield & APR = Annual Percentage Rate. Rates subject to change without notice. Some restrictions may apply, please contact Altana Federal Credit Union.

| Type | Maximum Terms | APR* |

| New (2021 - 2025) | 84 months | As low as 6.74% for 60 mos. |

| Used (2017 - 2020) | 72 months | As low as 6.99% for 60 mos. |

| Older (2016 or older) | 60 months | As low as 8.24% for 60 mos. |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed.

| Type | Maximum Terms | APR* |

| New (2018 - 2025) | 180 months | As low as 8.24% for 60 mos. |

| Older (2017 or older) | 120 months | As low as 9.24% for 60 mos. |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed.

| Type | Maximum Terms | APR* |

| New (2018 - 2025) | 180 months | As low as 8.24% for 60 mos. |

| Used (2017 or Older) | 120 months | As low as 9.24% for 60 mos. |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed.

| Type | Maximum Terms | APR* |

| New (2018 - 2025) | 180 months | As low as 8.50% for 84 mos. |

| Used (2017 or Older) | 84 months | As low as 8.50% for 84 mos. |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed. *** To ensure you have the most current rates, please use your browser’s refresh button to update this page.

| Type | Maximum Terms | APR* |

| Home Equity Line of Credit - Variable | 180 months | As low as 7.75% |

| In-House Mortgage and Secondary Market Programs Available | Various | Call now for current market rates |

| Home Equity - Fixed | 60 months | As low as 5.75% |

| Home Equity - Fixed | 120 months | As low as 6.50% |

| Home Equity - Fixed | 180 months | As low as 7.25% |

| Construction Loan | 12 months | As low as 7.00% |

| 5/5/5 ARM - 1st Mortgage | 5/15 variable | As low as 4.74% |

| 10 Year Fixed - 1st Mortgage | 120 months | As low as 4.99% |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. * APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed. Real estate loans are available on Montana residences only. HELOC Rates – Rate may change after the account is opened. APR will vary at Prime Rate as published in the Wall Street Journal. APR will not exceed 18.00%. The minimum credit limit is $5,000, the maximum is $150,000. The minimum payment is 1% of the outstanding balance at the last advance with a minimum of $50. A processing fee of $400 applies to cover closing costs. There are no fees for advances.

| Maximum Terms | APR* |

| 60 months | As low as 9.99% to 16.00% |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed.

| Type | Maximum Terms | APR* |

| Regular Shares | 144 months | 3.00% |

| Share Certificates | Term cannot exceed the term of the certificate. | 2.00% above certificate rate, rounded up to nearest .25% |

To ensure you have the most current rates, please use your browser’s refresh button to update this page. APR = Annual Percentage Rate. Rates effective as stated above. Rates are subject to change without notice. Rates determined on approved credit. The terms of repayment for a loan at a 6.55% interest rate would be $30.68 per $1,000 borrowed.

Life events can cause financial hardship, making bill-paying difficult. You don’t want delinquent payments and defaulted loans to cause you to lose your assets, negatively impact your credit rating, or cause financial distress for your family.

MEMBER’S CHOICE™ Borrower Security is a voluntary loan-payment protection product that helps you get relief from the financial burden of delinquency, default, or foreclosure if a protected life event unexpectedly happens to you. And, simple eligibility requirements ease the enrollment process.

If a protected life event happens to you (and you’re a protected borrower or co-borrower on the loan), Altana Federal Credit Union will cancel or reduce repayment of your loan debt – helping to lessen your worries, and your family’s worries, about paying loans during a time when your income may be reduced or lost and paying other household bills becomes challenging. Protected events include:

• Loss of life, including those caused by acts of war

• Disability, including those caused by acts of war

• Involuntary unemployment

Enjoy all of our products and services by joining Altana Federal Credit Union. To be eligible for membership you must live, work, worship or attend school in, or have a business located in the counties of Yellowstone, Carbon, Stillwater, Sweet Grass, Wheatland, Golden Valley or Musselshell. An original membership application will be sent to you. We will contact you to complete the application process.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What does this means for you? When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.